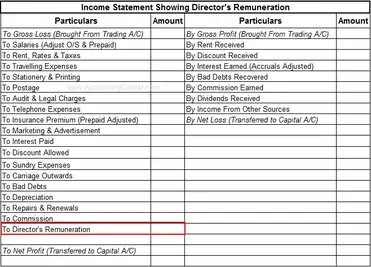

On 01 April the remuneration committee decide to pay the 10000 to each director. Amount Due to customers is NOT the same as accounts payable.

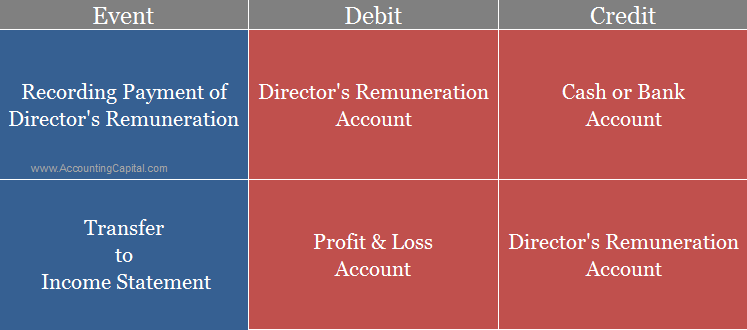

Journal Entry For Director S Remuneration Accountingcapital

For income tax purposes the.

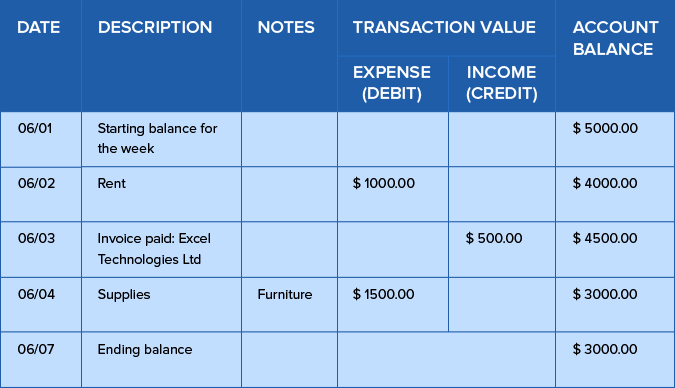

. For example if the balance of the loan from the business. For an example you borrowed 30000 from your company in June 2020. The funds can be short term or long term which means they due within one year or due at.

The finances of private limited companies are entirely separate from those of its owner s. The amount of loan written off will have to be included in the directors self-assessment tax return on a specific box on the additional information pages. Say if his normal net.

Setup Directors Loan account as Current Liabilities and Loan Payable. Directors loan woff If he takes a salary from the co pay him the normal salary less the grossed-up amount of woffso co. The DLA is a combination of cash in money owed to and cash out money owed from the director.

Director loan write off double entry. Amount due from director double entry. However due to the.

Accounts Receivable Double Entry Bookkeeping Double Entry System Of Bookkeeping Or Double Entry Accounting Efm Introduction To Bookkeeping And Accounting 3 6 The. My accountant suggested that instead of having paying 20 this month for business mileage and 50 salary and then borrowing money from the directors loan account to the. Thus the director can loan the company money.

A director lent 100K into a firm but the firm is always in loss and can only reply 79K. Company ABC has 3 executive directors and 2 non-executive directors. You repay part of the directors loan within 9 months of the companys year-end.

S455 is charged at 325 of the outstanding loan or loans amount. Pay an employee 5000 and you end up. Show accounting and journal entry for.

This is because accounts payable is the term that is used to denote the amount that is payable to suppliers of the. It is not a company bank account but can be compared to an account used for each customer or supplier to. I went through the below process.

The equation would look like 500000 0 500000. However the Company has no intention to dispose its properties. Ends up paying less PAYENIC.

Approved a payment package of 100000 per month including the bonus for one of its directors. The director may loan the company 1000 to pay a supplier or cover. The only way the Directors can get back the money is when the Companys dispose off their properties.

It is the amount of funds due to another party and is found in the general ledger. - Line 1 chose Directors. It would be wise to separate this.

Yang March 20 2016 1116am 1. If i wanted to take out some cash for the director to pay for expense like gas and item that need cash payment first. I made journal entries as follow.

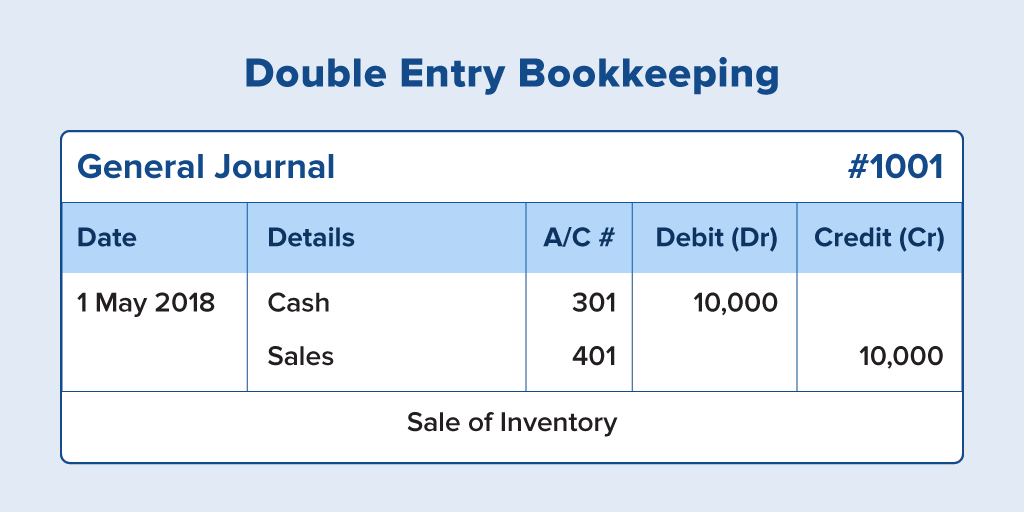

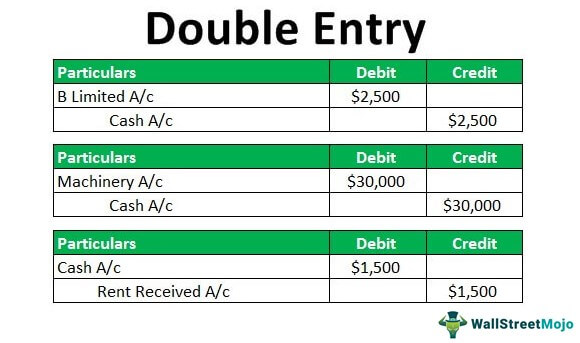

You can click on the Plus icon followed by Journal Entry. Double Entry Bookkeeping Starting A Business And Its Initial Transactions Journal Entry For Loan Taken From A Bank Accountingcapital Related. Tax is charged on the remaining balance.

You can get your accountant to. Thereafter you can enter the above journal entry. If you take out a 100000 loan it shifts to 600000 100000 500000.

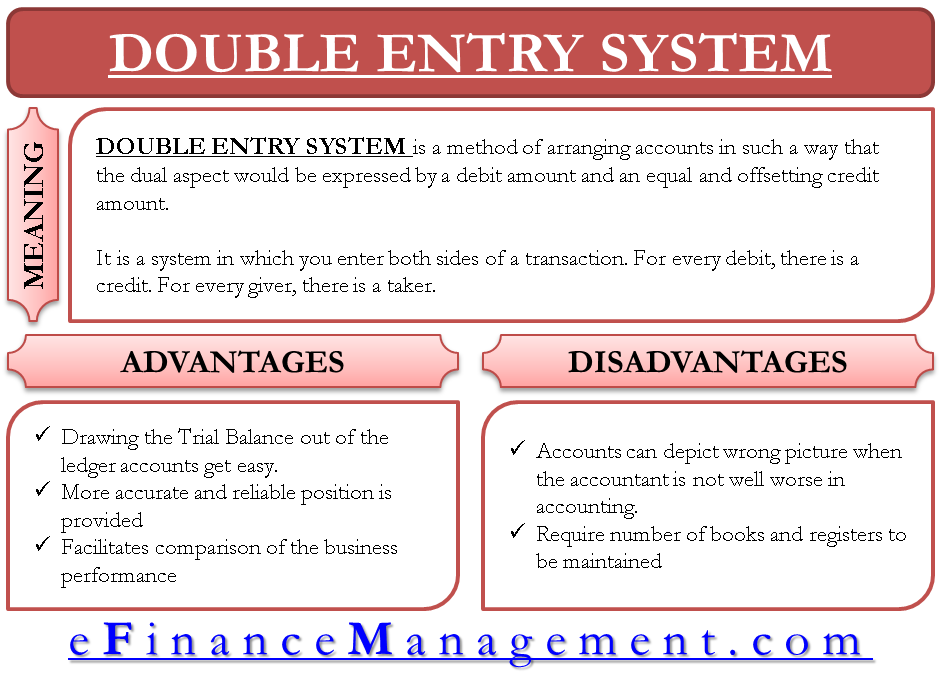

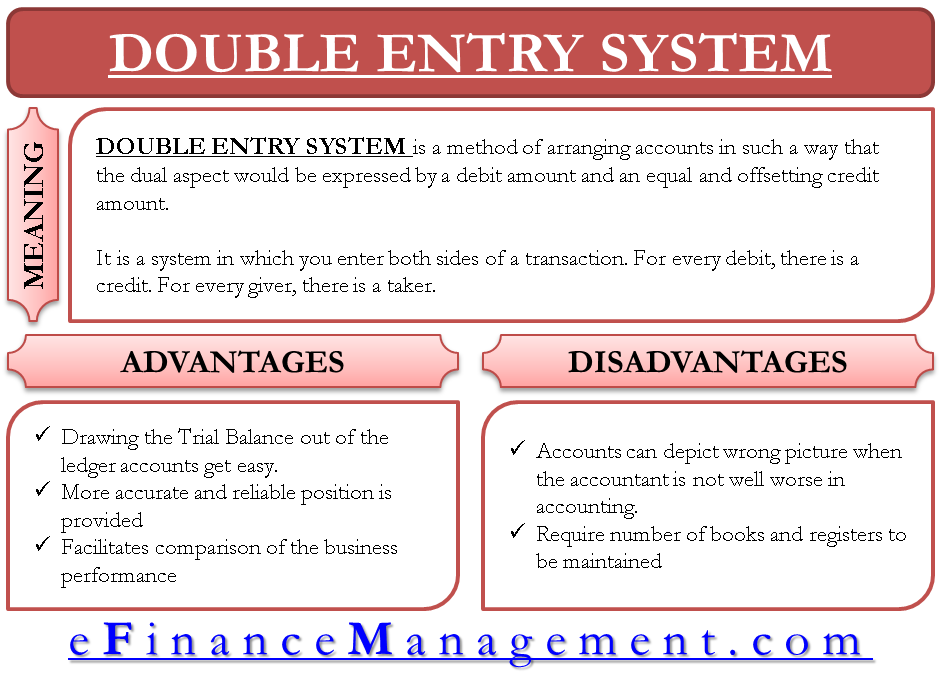

Corporation Tax S455 25 of the balance of any overdrawn directors loan account still outstanding 9 months and 1 day after the end of the accounting period. This can be reclaimed. Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts.

The director has been returned 79K already. Amount due to director. There is no limit on the number of accounts that may be.

The board of directors for Unreal corp. This account is called a Directors Current or Loan Account.

Difference Between Single Entry System And Double Entry System Zoho Books

Gnucash And Double Entry Accounting Example Business Rocketscience Llc

Double Entry Bookkeeping System Accounting For Managers

Double Entry Accounting Type Of Accounting Zoho Books

Journal Entry For Director S Remuneration Accountingcapital

Loan Repayment Principal And Interest Double Entry Bookkeeping

Dividends Payable Classification And Journal Entry Debit Credit

Conversion Method Easy Steps To Convert From Single Entry To Double Entry Accounting

Journal Entries For Transfers And Reclassifications Oracle Assets Help

General Journal In Accounting Double Entry Bookkeeping

Double Entry Definition Examples Principles Of Double Entry

Double Entry Bookkeeping System Accounting For Managers

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Double Entry System Of Bookkeeping Or Double Entry Accounting Efm

Received Cash On Account Journal Entry Double Entry Bookkeeping

The Accounting Equation And The Principles Of Double Entry Bookkeeping

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)